Tilray: International Growth Not Offsetting Canadian Headwinds

[ad_1]

karenfoleyphotography

Tilray Models, Inc. (NASDAQ:TLRY)

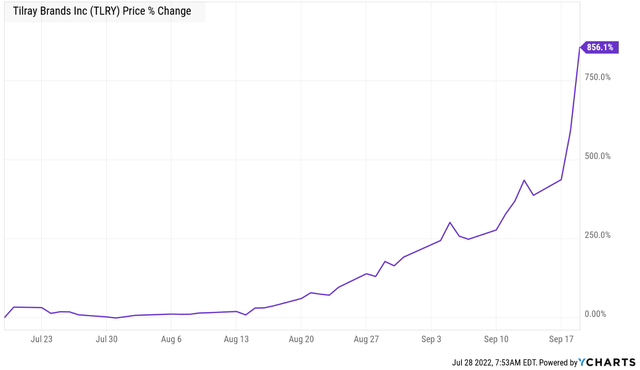

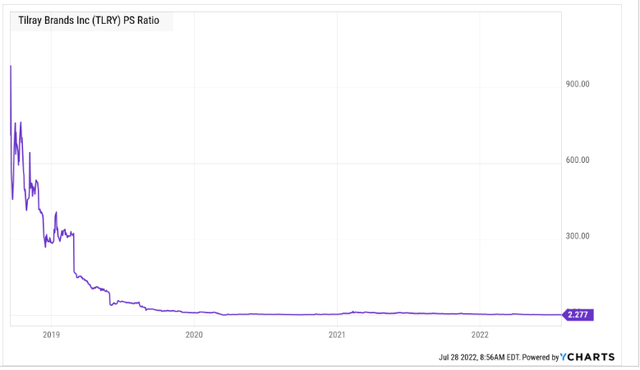

The enterprise needs minor introduction as every person who has traded the markets in excess of the last 5 years has possible figured out of its organization and the rather extreme short squeeze publish-IPO.

YCharts

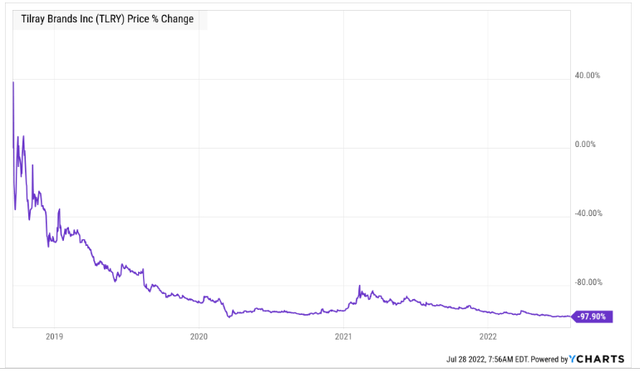

Of system, contrary to the bubbles of today, this 1 transpired 4 many years back and a lot of time and tide has handed since then. If you were being one of these that acquired at the peak, you shed 98% of your capital.

YCharts

But the organization has not long gone below and it is executing its turnaround approach. Turnaround stories take time. Frequently, the industry is disgusted with the efficiency at that precise instant and disregards the potential just when it should really be providing it the most credence. We examine the effects produced now and see whether or not Tilray may possibly be on the brink of having its act alongside one another.

Q4-Fiscal 2022

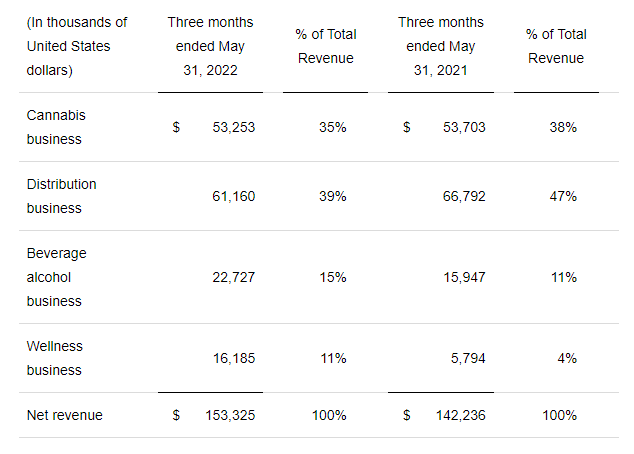

Hold in intellect that Tilray’s fiscal calendar year stop is in May well, so the benefits just released are their Q4 benefits from a fiscal standpoint. 2022 revenues grew 22% to $628 million compared to the prior 12 months. Q4 revenue grew only 8% to $153 million compared to previous yr. In equally comparatives, Tilray faced fairly strong forex headwinds from the US Dollar Energy. In Q4, for instance, Tilray’s revenues would have jumped 14% if measured modifying for forex adjustments.

While in general quantities had been excellent, two out of the 4 segments contracted even though the beverage alcoholic beverages and wellness locations grew briskly to lift the over-all quantities.

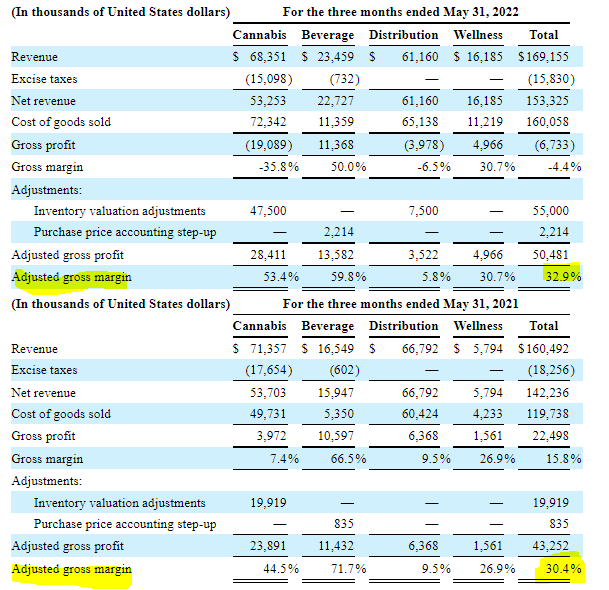

Tilray Q4 Success

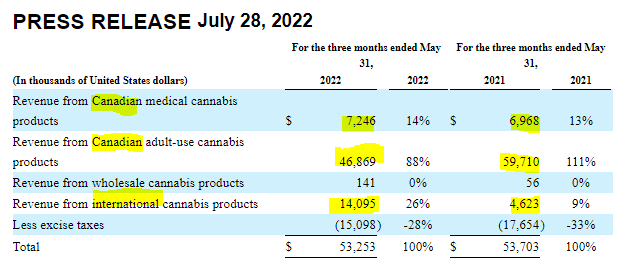

The contraction in Hashish is not shocking at all. The bulk of its earnings is coming from Canada, and that marketplace is a person of the most complicated to make income in. Legalization led to popular overcapacity and very a great deal no one can make cash in this article, thanks to significant overestimation of finish person desire. Tilray’s struggles are fairly acute in this article and the while the all round income figures looked alright, Canadian revenues are contracting sharply.

Tilray Q4 Final results

In our view, this current market is continue to ideal sizing alone and there will be a large amount of churn and potential destruction in the months and yrs in advance. As we observed with Cover Development Company (CGC), the figures in this article are likely to remain challenged as firms very clear our inventories and determine out how they can “agreement into profitability”. Certainly, if that appears like the actual reverse of what providers purpose to do, you study it suitable. It is just about not possible to go from losses to earnings even though shrinking revenues, but that is the task in advance for all these Cannabis firms. You could possibly be saying “wait a minute, didn’t Tilray just report a beneficial modified EBITDA number?”

That is a truthful issue. Tilray did have constructive adjusted gross margins for the full 12 months and in this quarter as well.

Tilray Q4 Outcomes

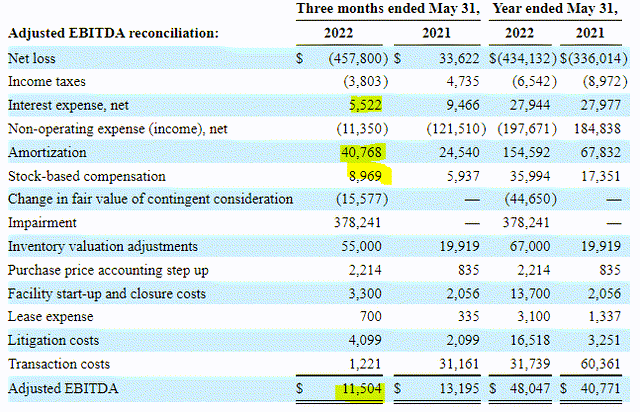

Sometimes “adjusted figures” get matters too significantly, but it is truthful to alter for inventory valuations. Altered gross margins essentially enhanced yr in excess of calendar year and at 32.9%, these are in fact 65% wide of CGC which claimed damaging 32% final quarter (See, Personal bankruptcy Pitfalls Are Growing Like A Weed). We are fine with the modified gross margins, but we will not equate that adjusted EBITDA as remotely resembling profitability. It is not challenging to observe our logic if we see how the enterprise works by means of modified EBITDA from net losses.

The $11.5 million in altered EBITDA this quarter was a prime beneficiary of numerous insert backs. At a least we believe that true interest fees, depreciation and stock based payment ought to be deemed by investors looking to actually make cash somewhat than obtaining seduced by claims of “progress”. People 3 account for about $55 million of bills in the previous quarter as opposed to the $11.5 million of adjusted EBITDA.

Tilray Q4 results

Some might argue that depreciation and amortization are not serious charges, but for a manufacturing and distribution business, they absolutely are. When Tilray’s facilities might be up and working and routine maintenance expenditures might seem low, you can anticipate it to invest at minimum as a great deal as the amortization line more than the extended operate to up grade these similar amenities.

Outlook

Tilray’s success has occur largely from its progress in Germany where by it is outselling the competition. In Canada, Tilray faces just one of the most fiercely competitive marketplaces and there are close to 800 accredited producers competing to go bankrupt ahead of all people else. Tilray is striving to direct some consolidation here and it not long ago obtained HEXO’s senior secured convertible notes. We will have to see how this performs out, but with 800 producers, we feel it will just take a lengthy time ahead of the business sees financial gains. In our feeling, the two areas (global and Canada) glance like they will offset each individual other for 2023 and we really don’t see any massive enhancement in EBITDA in the subsequent 12 months.

On the US aspect, Tilray had obtained Manitoba Harvest to distribute CBD. It also expanded its attain when it acquired some of MedMen’s fantastic convertible notes. All those spots set it up for upcoming expansion, when US Hashish use is legalized at a Federal Level. None of that will assistance in the following 12 months although. SweetWater Brewing property are most likely to be a superior resource of gross margins, but they is not going to be a video game changer any time shortly as the beer segment will mature gradually.

Verdict

900 moments profits. That is what “buyers”, and we use the phrase with highest disdain, paid out for Tilray at its peak. Scott McNeely designed pleasurable of the plan that any one would fork out 10X revenues (for his corporation).

At 10 instances revenues, to give you a 10-calendar year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero charge of products bought, which is quite challenging for a computer system corporation. That assumes zero expenses, which is seriously tricky with 39,000 personnel. That assumes I shell out no taxes, which is really challenging. And that assumes you pay back no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the up coming 10 a long time, I can sustain the present-day income operate fee. Now, having carried out that, would any of you like to acquire my inventory at $64? Do you understand how preposterous those essential assumptions are? You do not will need any transparency. You never need any footnotes. What were you imagining?

Source: Bloomberg

He could not be achieved for comment on what he thought about shelling out 900 times revenues.

Fortunately, we have mounted that difficulty by giving traders a 98% haircut together with some superior bounce in revenues.

YCharts

Existing valuation is not as well demanding for Tilray and it stays simply the chief in the Canadian area. As opposed to CGC, a different stock we address, we will not give this a sell ranking as its altered gross margins are excellent and stability sheet is significantly far better. We are initiating coverage at neutral/keep and feel this ought to be on trader observe lists for a extended expression prospect down the line.

Be sure to be aware that this is not economic guidance. It may appear like it, seem like it, but shockingly, it is not. Investors are predicted to do their own due diligence and consult with a qualified who appreciates their aims and constraints.

[ad_2]

Source connection