What’s Written in the Stars for Constellation Brands?

[ad_1]

In his first “Executive Decision” segment of Friday’s Mad Money program, Jim Cramer spoke with Bill Newlands, president and CEO of Constellation Brands (STZ) , the wine and spirits maker.

Newlands said Modelo continues to be “on fire” and is now the number two brand in dollar sales. There’s still more runway for growth, he added, as they’re still only fifth amongst draft beers.

When asked about how beer sales respond in a recession, Newlands noted that beer is an “affordable luxury” for many people and beer sales do very well in tough inflationary times.

Let’s check out the charts before it gets to five o’clock.

In the daily bar chart of STZ, below, we can see that the shares have traded sideways in a large high/low range the past twelve months. Prices are currently back above the bottoming 50-day and the bottoming 200-day moving averages.

The trading volume has been uneven and active while the On-Balance-Volume line has followed the price action. The OBV line is closer to breaking its January zenith than prices are.

The Moving Average Convergence Divergence (MACD) oscillator crossed above the zero line in late March for an outright buy signal.

In the weekly Japanese candlestick chart of STZ, below, we can see that the shares are rallying towards their January highs. Notice the upper shadows above $250 telling us that traders rejected those levels. The slope of the 40-week moving average is starting to bottom with prices trading above it.

The OBV line is positive. The MACD oscillator is ready to cross to the upside for a new outright buy signal.

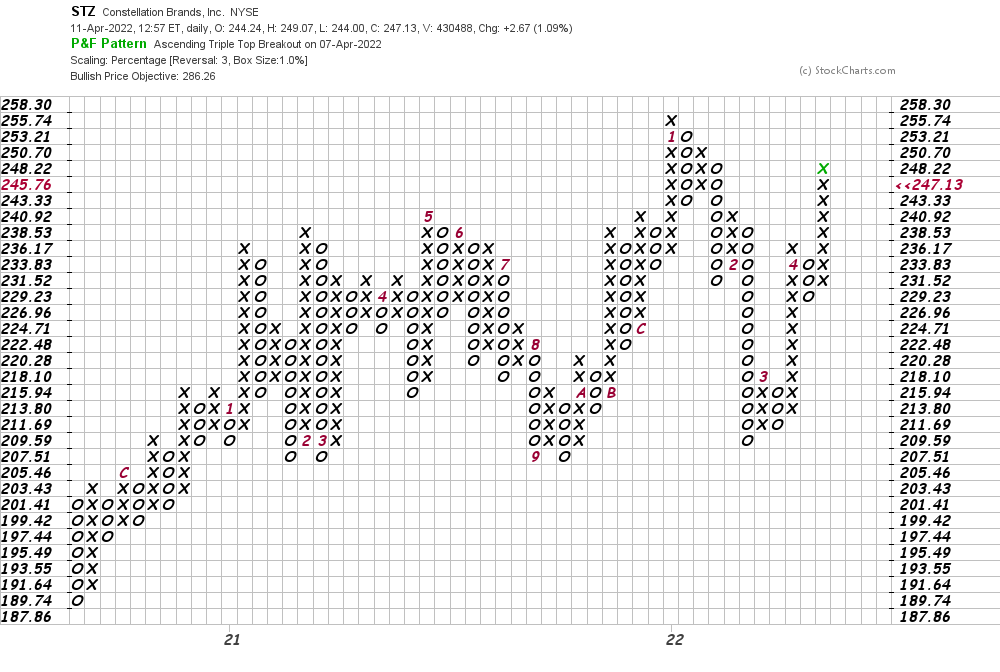

In this daily Point and Figure chart of STZ, below, we can see a potential upside price target of $286. A trade at $258.30 is needed to refresh the uptrend.

In this weekly Point and Figure chart of STZ, below, we can see a possible $322 price target.

Bottom-line strategy: Stepping back a few steps from the computer screen I consider the charts of STZ to be mixed. The odds probably favor the upside but weakness in the broader market averages is keeping me on the sidelines. Further sideways price action may be the end result.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

[ad_2]

Source link